Medicare D History and 2015 Status

It may be hard to believe now, but it was only in 2006 that prescription drug coverage became a standard program under Medicare (created in the 2003 Medicare Modernization Act). Now, more than 17 million Medicare enrollees receive prescription drug coverage via the private plans involved in Medicare’s Part D program.

In 2015, 1,001 prescription drug plans will be offered across the U.S. The number of available plans has varied over the years since Part D began and 2015 has the lowest number of plans thus far. However, enrollees in all states have access to at least a dozen plans (along with additional Medicare Advantage options).

Prescription Drug Coverage Choices

Medicare D is a voluntary program. Typical choices for retirees in terms of how they get prescription drug coverage include: Medicare D, Medicare Advantage Plan (combined coverage via private companies), employer plans (employer sponsored coverage for workers or retirees), VA programs such as TRICARE, and Medicaid. If a Medicare eligible person has creditable (aka similar benefits) coverage, he/she does not have to enroll in Medicare Part D and will face no future penalties. One can also choose not to enroll without creditable coverage, but will later be subject to a penalty if seeking Medicare D coverage (therefore potentially making it worthwhile to sign up for one of the low premium plans even if you don’t take medications or have very small costs that you feel you could handle on your own).

The Doughnut Hole

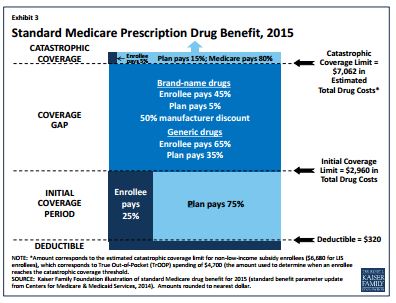

One of the most confusing aspects of the Part D program as designed in the Medicare Modernization Act was the gap in coverage, known popularly as the “doughnut hole”. This means that beneficiaries have certain coverage up to a level (with the standard benefit in 2015, 25% coinsurance for the beneficiary up to $2960 in total drug costs), then have to bear more of the costs themselves until they hit a “catastrophic level” of costs, when greater coverage kicks in again. See below for a graph from the Kaiser Family Foundation showing how the standard benefit works in 2015 (plans generally offer slightly different benefits than the standard plan, however).

Subsidies for Drug Coverage

Subsidies for Drug Coverage

Part D includes premium assistance and cost-sharing for low income beneficiaries (less than 150% of poverty, or $17,505 for individuals in 2014) and modest assets (less than $13,440 for individuals in 2014). In 2015, 283 plans will be available for enrollment of Low-Income Subsidy (LIS) recipients for $0 premium. About 11 million people currently take advantage of these low-income subsidies, but there are likely many more beneficiaries who would be eligible. There are a number of Medicaid programs that offer assistance with medical costs as well (look for an upcoming post where we outline these in some depth or contact us if you have immediate questions) and dual-eligible individuals automatically qualify for additional assistance.

Annual Enrollment Period (October 15-December 7)

We’re about a week away from the Medicare D annual open enrollment period, so now’s the time to prepare for 2015! Because plans change every year (many fewer are participating this year for one thing) and your personal situation changes, take the time to make sure you are in the right plan.

We can help! Call us at 727-447-5845 if you’d like help navigating your options for the coming year. Our independent patient advocates do not sell insurance and can offer you the expertise you need to save time and money.

Popular Downloads

Popular Downloads

Get Our Newsletter!

Get Our Newsletter! Mission Statement

Mission Statement