LTC in Florida

LTC, or long-term care, is something more and more people understand they need to plan for in their retirement, insurance, and health planning. However, very few really understand what LTC is or how to approach planning for it. We’ll share some key LTC facts and Florida LTC costs and let you know about a great workshop coming up where you can learn from one of our area’s foremost LTC experts.

What is LTC?

Long term care is the type of care many people need for some period of time as they age. It is not acute medical care (i.e. surgery and immediate after-care or treatment for an injury or illness) but the type of “custodial care” that includes help with getting around, safety support and assistance with ADLs and iADLs.

Long term care isn’t a place (i.e. a nursing home) but can be provided at home, in day time settings (adult day care/programs), at an Assisted Living Facility (ALF), nursing home and sometimes in other settings. It can be provided by family members, and families do provide millions of dollars worth of unpaid care each year. However, many people will also need paid assistance at some point and the costs (as you can see below) can be quite staggering if you have to pay “out of pocket” (from your income and savings).

What does LTC in Florida cost?

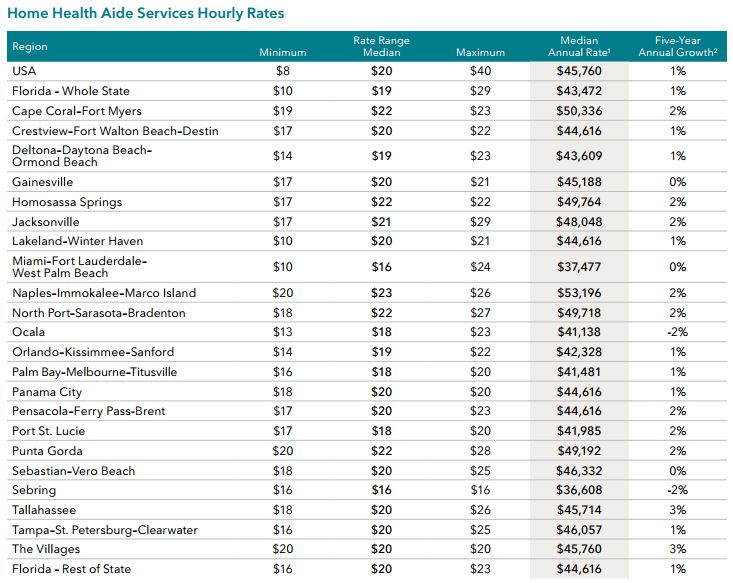

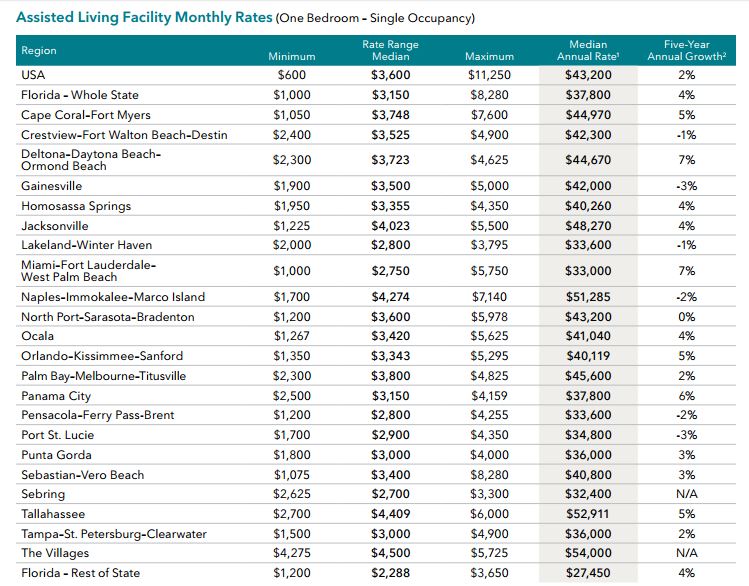

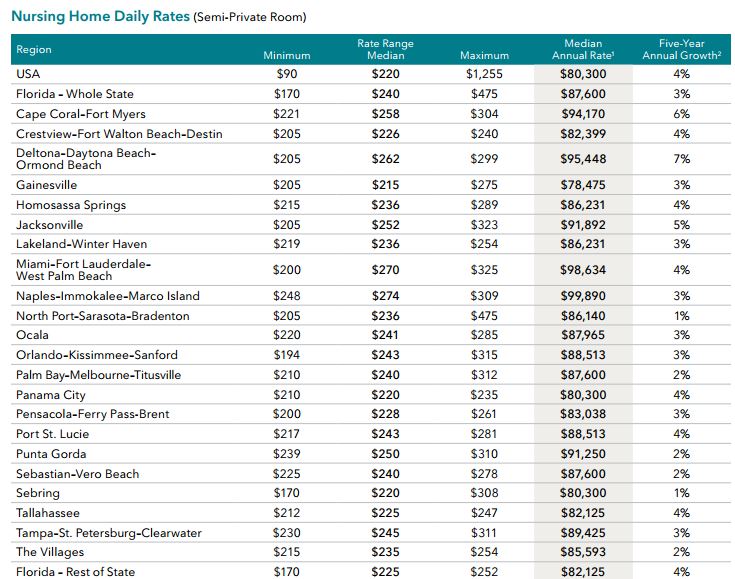

Here is some general data from Genworth’s 2015 survey of long term care costs. Join Linda Chamberlain for our upcoming LTC workshop to learn more specifics about budgets, options and resources to pay for LTC.

Home health aide costs for Florida LTC (in-home care)

Florida ALF costs

Nursing home costs in Florida for LTC

To understand more about the various options for long-term care and the true costs involved, we encourage you to attend our upcoming LTC workshop. Linda Chamberlain, Aging Wisely founder and Board Certified Elder Law Attorney, has worked in LTC and Medicaid planning for 25 years. She will share valuable information and planning tips, as well as answering your questions.

Want to understand what Medicare covers? Confused about Medicaid v. Medicare? Considering buying LTC insurance or worried about how you’ll cover costs from your retirement savings? Want to understand why planning is worthwhile and how you can maximize your choice as you age? This workshop is for you!

How to Pay for Long Term Care

Tuesday, April 5, 2016

1:00-2:30 PM

1180 Ponce de Leon Blvd., Suite 700, Clearwater, FL 33756

Click here for the LTC workshop flier and RSVP to hold your seat today (space is limited!). You can call us at 727-447-5845 for reservations or questions.

Popular Downloads

Popular Downloads

Get Our Newsletter!

Get Our Newsletter! Mission Statement

Mission Statement