Our Medicare advocates are here to help you understand Medicare as we’re in the midst of the Medicare 2016 open enrollment decision making. Today, we’ll answer some FAQs about Medicare, such as “What is Medicare going to cost me in 2016?” and “What is Medicare going to cover in 2016?” and “Will I be subject to a big Medicare Part B increase?”. We also help you find a broad range of information, such as “What is Medicare?” and “What is Medicaid?” and when you need to sign up and take certain steps.

What is Medicare going to cost me in 2016?

All of the numbers are not out yet, but sign up for our newsletter to get all the details as soon as they come out! We do know what Medicare Part D’s maximum deductible will increase from $320 to $360. Of course, this is only the maximum limit placed on the plans. Your drug plan may have no deductible at all and can range up to $360 (however, a Kaiser Family Foundation issue brief revealed that 2/3 of all Part D plans will have deductibles and a growing share will have the maximum deductible in 2016).

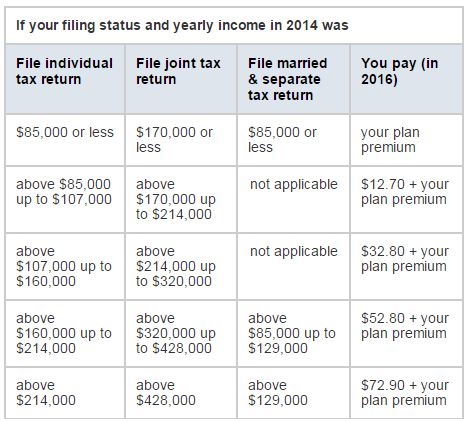

Part D plan premiums vary widely (as do the associated costs for covered medications) so it is important to analyze the best plan for your current situation during open enrollment. For 2016, the chart below details the income-adjusted premiums for Part D. In other words, if you are looking at a particular Part D plan and your income is more than $85,000 (or $170,000 for joint filers)–based on your 2014 return–you will need to add the extra cost to this premium to get your true monthly cost.

The average Part D premium is projected to increase by 13% from 2015 to 2016 ($36.68 to $41.46). Even if a number of beneficiaries switch/are reassigned to lower-premium plans, the average increase is likely to be the largest since 2009 (Kaiser Family Foundation).

Most of the other Medicare costs will likely stay similar to 2015. However, a big area of concern for some Medicare recipients is the potential 52% hike in their Medicare B premium if they are not protected by the “hold harmless” rule.

What is Medicare “hold harmless” and will I be subject to a large Part B premium increase in 2016?

Social Security benefits will not get a COLA (Cost of Living Adjustment) next year, which means that most Social Security recipients who are also Medicare beneficiaries will not see an increase in their Part B premium ($104.90–stable since 2013) under Medicare’s “hold harmless” provision. But this “hold harmless” rule doesn’t apply to about 30% of beneficiaries: those who are not yet receiving Social Security, new Medicare beneficiaries, individuals earning more than $85,000 a year (or $170,000 for joint filers), and Medicare/Medicaid “dual eligibles” (though for dual eligibles, the burden will fall mostly to the state Medicaid programs).

Unless Congress or the administration make some modifications, these Medicare beneficiaries will generally be facing a Medicare B premium of $159.30, with higher income retirees paying as much as $509.80/month. The Part B deductible for these beneficiaries would rise to $223 next year (from $147 in 2015). This is due to the fact that premiums must cover cost increases within the Medicare program, and since about 70% of people are protected by the hold harmless rule this puts a large share of cost on the remainder.

What is Medicare open enrollment, when is it and what to I need to do?

Medicare open enrollment is your chance to switch Medicare D plans for 2016 (and switch to/from Medicare Advantage). Read more about Medicare open enrollment 2016 and what you need to do during this period (October 15th-December 7th). If you need help with this process or initial Medicare enrollment, our Medicare advocates can assist with our Medicare Analysis Package.

Find out more about Medicare and Medicaid at:

Aging Wisely’s Medicare Fact Sheet (2015 version), includes all the basic facts about Medicare and key dates

Medicare.gov: get your Medicare 2016 handbook, compare plans, find out what Medicare covers and more

Medicare Interactive answers questions about Medicare rights and benefits, run by the Medicare Rights Center.

What is Medicare? What is Medicaid? Who Pays? by EasyLiving’s senior care experts, with links to fact sheets about Medicare’s coverage of home health care and other resources

Contact our healthcare advocates for any questions about Medicare, Medicaid, other benefits and your health needs. We do not sell insurance or any products, so our opinions are based on our experiences helping many families and our analysis of what’s best for you!

Popular Downloads

Popular Downloads

Get Our Newsletter!

Get Our Newsletter! Mission Statement

Mission Statement