Can I Take My Loved One Out of the Nursing Home?

Our experts help with your frequently asked eldercare questions. With the holidays coming up this is an especially timely topic: handling holiday (and other) visits when your loved one lives in a nursing home.

Can I take my loved one out of his/her nursing home for an outing or holiday visit?

Yes, residents of nursing homes can definitely leave the nursing home for outings and visits with family. Of course, the nursing home is regulated tightly and residents are considered to be under medical care while there, so it is necessary to follow certain procedures.

You should talk to your loved one’s nursing staff about outings, to ensure the person’s safety and well-being. The staff can also prepare you for what might be needed during the trip, such as equipment and care needs. If you have not personally taken care of your loved one alone in some time, it is important to understand their needs before planning a nursing home outing.

Typically, you will need to “sign out” a nursing home resident and talk to the care staff about the plan and timing of the visit. It is important to let them know the intended length of the visit and keep in touch if anything changes, so they can plan accordingly. There are also financial implications for overnight/longer visits.

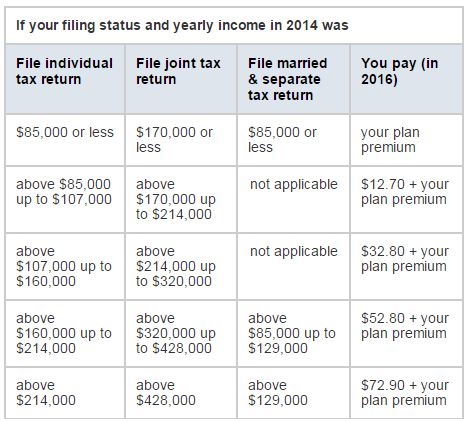

Florida Medicaid Rules for Holding Nursing Home Beds

In addition to whether or not you can leave a nursing home and what type of visits are advisable, costs are an important factor to consider. If a resident leaves a nursing home overnight, they (or some payment source such as Medicaid) would need to continue to pay the cost to hold their spot. For a private pay resident, monthly payment would simply be as usual and then the bed would be held (for longer stays away from the nursing home–even hospital stays, the resident/family would have to determine if they wish to pay to hold the bed).

This is known as a “bed hold” in Medicaid terminology and the policies vary by state. For what is known as “therapeutic leave”, Medicaid in Florida pays the nursing facility to reserve a resident’s bed a maximum of 16 days per fiscal year (July 1-June 30). Therapeutic leave means the resident leaves the facility to go to a family-type setting (not another nursing home or hospital). Each night away counts as one day.

However, the nursing home must have at least 95% of its Medicaid-eligible beds filled in order to bill the state for bed hold days (presumably, if not, there would be sufficient open beds for the person to return). If a resident exceeds the yearly allowed days, the resident or family could also pay privately to hold the bed. If they do not wish to do so, the nursing home may discharge the person but must readmit them in the 1st available Medicaid semi-private bed (of course, it does not have to be the same room as before).

The nursing home should provide this policy in writing, at admission and again when you go on any therapeutic leave. For a complete list of Medicaid bed hold policies by state click here (check with your state to see if the policies have changed since this was updated).

Medicare Skilled Nursing Coverage and Leaving the Nursing Home

Medicare only covers short-term skilled nursing care, so this isn’t an issue for most nursing home residents. However, if you are in a skilled nursing facility receiving treatment under Medicare and wish to leave to visit loved ones for the holidays, can you?

Despite what you are sometimes told, Medicare does not necessarily consider a family visit to mean you don’t need skilled care. You can be gone during the day (attending an outing, but back by midnight that day) and the facility can still bill Medicare for the day. If you stay away overnight, the facility typically can’t bill Medicare for that day. You can talk to the facility about their bed hold policy, and you may be able to privately pay to hold the bed if you wish.

Remember, however, that missing out on therapy services, in particular, may slow your recovery process and you may benefit less from your time in the skilled nursing facility. It is best to discuss your needs and scheduling of any visits with your care team.

The Logistics of a Nursing Home Outing

We have many clients who we arrange regular outings for, often with the help of a nursing assistant. We would never want our clients to feel that the nursing home is like a prison, but we also want to make arrangements to make any visit safe and comfortable.

Talk with care staff about the details beforehand and consider whether some assistance might be needed. You can arrange special transportation or an aide to go along with the person, to assist with transferring, going to the bathroom and other needs that may arise.

Our senior caregivers have shared tips and information about traveling with someone with dementia and they offer senior concierge services to plan events/outings and escort the person (even on long-distance trips to visit family).

We can also help with creative ideas for making the holidays special for your loved one residing in a nursing home or assisted living. Contact us for ideas or help with nursing home visits, concierge services, patient advocacy and more.

Also, don’t forget to check out our Senior Gift Guide!

Popular Downloads

Popular Downloads

Get Our Newsletter!

Get Our Newsletter! Mission Statement

Mission Statement