Each family’s senior care situation is a bit unique, but there are common conflicts that arise. One challenging dynamic that sometimes leads to conflict is when one (or more) family caregivers live near the aging parent and the others are long-distance caregivers. The perspectives naturally diverge, and each party may feel certain resentments toward the others, even in a family where everyone generally gets along.

Each family’s senior care situation is a bit unique, but there are common conflicts that arise. One challenging dynamic that sometimes leads to conflict is when one (or more) family caregivers live near the aging parent and the others are long-distance caregivers. The perspectives naturally diverge, and each party may feel certain resentments toward the others, even in a family where everyone generally gets along.

Today we want to share the story of two daughters, one local and one long-distance, dealing with Florida elder care concerns. Though your situation may not be exactly the same, we hope the lessons and tips that arise from the story will help.

This caregiving story begins a little over five years ago, when the elderly parents began needing assistance. Dad started having some symptoms and was diagnosed with cancer–a surgery ensued and Dad’s health begin a slow decline. Daughter #1 lives in the same town and began spending significant time caregiving. At one point, she was not only assisting with grocery shopping, cooking and medical appointments, but also spending many nights in the home and providing round-the-clock supervision several times when Dad was hospitalized. She realized she had to get some outside assistance when both her health and work were significantly impacted (keep an eye out for our upcoming article giving “the real scoop” on caregiver stress and self-care). She was able to locate home caregivers through a Florida home health agency to provide some of the hands-on care that Dad needed and give her an occasional break. However, she still managed many tasks as well as coordinating the care and handling several “emergency” calls each day from her mother. To ensure her parents accepted the care without letting money worries be a barrier, daughter #1 paid for the home caregiver services.

Dad died after a four-year battle with cancer. Mom is now living alone and has caregivers helping a few times/week and daughter #1 handles all the same tasks for Mom she did for both, as well as increased time together and reassurance since Mom has become a widow.

Daughter #2 lives in the midwest, about a two hour flight from Florida. The daughters have always been close, and both get along well with their parents. She visits during holidays, and she tried to increase visits to once every couple months once Dad got sick. She talks to her sister about twice/week and often more frequently. She didn’t talk to Dad often over the phone because he was not a “phone person” but talks to Mom about once/week. She flew down a couple times to help out during Dad’s hospitalizations, but cannot always travel due to her demanding work schedule. Both daughters are married with older children (but still finishing college) and have full-time professional jobs.

As in many cases of one local and one long-distance caregiver managing senior care, the sisters are playing very different roles and therefore have very different perspectives. Generally, things seemed to be going along fine until a recent holiday visit.

Daughter #2 spent time with Mom during the visit. She noticed that Mom has become very attached to her caregivers and mentioned a few things that concerned her, such as wanting to “help out” their families. Several things Mom said made her feel perhaps she was too attached and she wondered about the caregivers’ roles in encouraging this or having undue influence on Mom.

She brought up her concerns to her sister and said she was “panicked” over this and what might happen. She made a number of criticisms about the caregivers. This immediately made her sister feel angry and unappreciated. Daughter #1 also noted that her sister was criticizing, while offering no solution (and no offer of help). This brought to the surface a lot of feelings about all that she has done for the past five years on a day-to-day basis (and financially). She doesn’t feel that her sister has any understanding of the amount of stress and the time she has spent coordinating care, answering phone calls and handling every detail. This situation has really soured the relationship…and continues to cause various repercussions for the whole family.

Senior care is tied up with many emotions for families, and the stress of the situation can easily damage even good relationships. Most likely in this situation the long-distance caregiver did not mean for her comments to come across as they did, and many long-distance caregivers struggle with their own feelings of guilt or inadequacy (or in other situations, feeling they are being isolated from the situation or that the local caregiver has handled things inappropriately).

The diverging perspectives open up a mine field of potential conflicts. Here are some ideas that might help if your family is geographically separated (we have categorized them by party, but some of them apply to both parties).

Tips for the long-distance caregiver:

- Express appreciation for what your sibling handles on a day-to-day basis and consider the type of stress he/she may be feeling. Long-term caregiving on a daily basis is a chronic stress. The caregiver often gets constant phone calls about little issues, but also has to worry what crisis might be happening every time the phone rings.

- Consider the skewed picture you might be getting. Aging parents have a way of pulling things together for visitors (or making things seem worse or complaining to one side, depending on the personality). Your parent’s story may not really be the full one.

- Think about how you raise issues and how the language you use might be perceived. To come in to the situation where your sibling has had primary responsibility with harsh words can cause an immediate wall between you.

- Realize that even if your sibling has willingly taken on certain duties with little complaint, paid for care or otherwise handled tasks, he or she may be feeling a little resentful of what may seem like a skewed burden.

- Offer solutions, not just criticisms. If there is something you are concerned about, think about how you want to approach the issue first and do not bring it up if you don’t have a solution to propose (and a willingness to help with it).

- Try to work out some significant time to offer respite care. It can help you to see the situation more fully, in addition to giving your sibling a break. But, when you come in to help think about how changes or criticisms might be perceived as well, and do some preparation with your sibling to help the respite time go as smoothly as possible.

Tips for the local senior caregiver:

- Find ways to involve the long-distance caregiver. Can senior care providers share notes with both of you (“real time” communication–especially directly from providers–versus summarizing how things are going later can make a big difference)? What tasks can the long-distance caregiver do?

- Try to give your siblings and aging parents time alone when they visit.

- Consider holding family meetings–when senior care needs first arise and on regular intervals. You might want to engage a geriatric care manager to help guide the agenda and conversation. This could coincide with an evaluation, so everyone can get input and suggestions from an outside party.

- Express what you might want or need from the other relatives. The family conferences above can be a good time to do this, and talk through feelings you have about the care situation. A geriatric care manager or qualified counselor can help you deal with your concerns and emotions and communicate effectively. In some cases, family mediation services may be needed.

In many cases, these situations are more complex before the senior care even begins. When dealing with pre-existing family conflicts or other complexities, we always advise seeking professional advice and being open with your advisors about these issues so they can help you with planning tools.

Whatever stage of caregiving or family situation you are dealing with in senior care, it’s always a good time to get some professional advice to move forward in a more positive direction. We can help with family care planning sessions, independent assessments and more:

Just give us a call at 727-447-5845 (toll free 727-447-5845).

Have you experienced one side or the other–being the local caregiver or the long-distance caregiver? Either side can be challenging in its own way, more so depending on the relationships involved. We welcome your comments or input!

Did you like this? Share it:

The Wall Street Journal recently published a great essay entitled,

The Wall Street Journal recently published a great essay entitled,  Here’s our “top 10 list” of signs that you might want to seek help from a geriatric care manager with your aging parents’ care or eldercare concerns. These are some of the common patterns that begin to build in our lives as we strive to care for loved ones as they age or suffer from various health issues. If these patterns sound familiar, it is a perfect time to reach out to a geriatric care manager in your parents’ local area to plan a consultation and/or geriatric care management assessment.

Here’s our “top 10 list” of signs that you might want to seek help from a geriatric care manager with your aging parents’ care or eldercare concerns. These are some of the common patterns that begin to build in our lives as we strive to care for loved ones as they age or suffer from various health issues. If these patterns sound familiar, it is a perfect time to reach out to a geriatric care manager in your parents’ local area to plan a consultation and/or geriatric care management assessment. At least 1.5 million Americans are sickened, injured or killed each year by errors in prescribing, dispensing and taking medications.

At least 1.5 million Americans are sickened, injured or killed each year by errors in prescribing, dispensing and taking medications.  By now, it’s likely you have heard the news story about the nurse who refused to do C.P.R. on a retirement community resident who later died. Sally Abrahams did a good review of the story on her

By now, it’s likely you have heard the news story about the nurse who refused to do C.P.R. on a retirement community resident who later died. Sally Abrahams did a good review of the story on her  Yahoo’s CEO has stirred up some controversy and debate with her recent work-from-home ban for her company’s employees. In case you have somehow missed the story, a memo was leaked in which the company’s head of human resources ordered telecommuting employees to begin reporting in to the office. Yahoo’s CEO has decided to end telecommuting for her employees, in efforts at improved collaboration via face-to-face interaction.

Yahoo’s CEO has stirred up some controversy and debate with her recent work-from-home ban for her company’s employees. In case you have somehow missed the story, a memo was leaked in which the company’s head of human resources ordered telecommuting employees to begin reporting in to the office. Yahoo’s CEO has decided to end telecommuting for her employees, in efforts at improved collaboration via face-to-face interaction. As we age, we tend to face a lot of life changes which sometimes feel beyond our control. These transition points naturally bring stress. However, the way they are handled can make a significant difference in the experience and perception of the change.

As we age, we tend to face a lot of life changes which sometimes feel beyond our control. These transition points naturally bring stress. However, the way they are handled can make a significant difference in the experience and perception of the change. According to the National Association of Home Builders, nine out of 10 people over age 50 are committed to living in their own homes for as long as possible. In order to make this work, many people need to make home improvements to ensure maximum mobility when physical health declines.

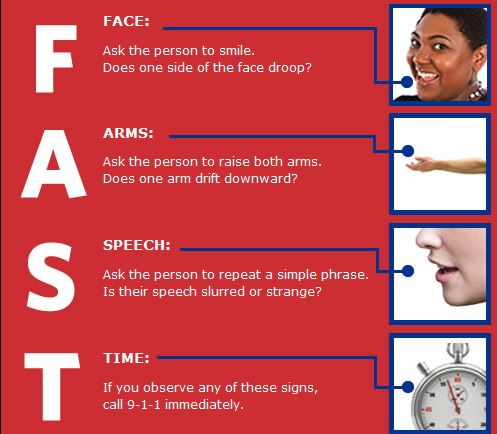

According to the National Association of Home Builders, nine out of 10 people over age 50 are committed to living in their own homes for as long as possible. In order to make this work, many people need to make home improvements to ensure maximum mobility when physical health declines. *From the National Stroke Association

*From the National Stroke Association When a senior and family make the big decision to consider moving to senior housing, evaluating the choices can be daunting. We have several resource articles and fact sheets on different levels of care in senior living and will be covering more of your questions on this topic in upcoming posts. Today we offer some valuable information that can help you more clearly evaluate assisted living facilities.

When a senior and family make the big decision to consider moving to senior housing, evaluating the choices can be daunting. We have several resource articles and fact sheets on different levels of care in senior living and will be covering more of your questions on this topic in upcoming posts. Today we offer some valuable information that can help you more clearly evaluate assisted living facilities. Each family’s senior care situation is a bit unique, but there are common conflicts that arise. One challenging dynamic that sometimes leads to conflict is when one (or more) family caregivers live near the aging parent and the others are long-distance caregivers. The perspectives naturally diverge, and each party may feel certain resentments toward the others, even in a family where everyone generally gets along.

Each family’s senior care situation is a bit unique, but there are common conflicts that arise. One challenging dynamic that sometimes leads to conflict is when one (or more) family caregivers live near the aging parent and the others are long-distance caregivers. The perspectives naturally diverge, and each party may feel certain resentments toward the others, even in a family where everyone generally gets along.

We’ll start with a quick definition of Medicaid and how it differs from Medicare. Medicaid is a joint federal-state program which provides various health-related benefits to individuals who meet financial qualifications. The federal government provides funding and the states provide additional funding, as well as administer the wide array of specific programs that fall under the category of Medicaid. You may have heard of a poor, young child receiving Medicaid to cover doctor’s visits and medications, while at the same time you may realize this is the program your grandmother qualified for to assist her in paying her nursing home costs when she had no money left. This is what makes Medicaid so confusing–it covers a wide range of programs and the qualifications for each vary. The important point is to understand that it is a means-tested program, administered by the states to cover health care for various groups considered low-income/vulnerable.

We’ll start with a quick definition of Medicaid and how it differs from Medicare. Medicaid is a joint federal-state program which provides various health-related benefits to individuals who meet financial qualifications. The federal government provides funding and the states provide additional funding, as well as administer the wide array of specific programs that fall under the category of Medicaid. You may have heard of a poor, young child receiving Medicaid to cover doctor’s visits and medications, while at the same time you may realize this is the program your grandmother qualified for to assist her in paying her nursing home costs when she had no money left. This is what makes Medicaid so confusing–it covers a wide range of programs and the qualifications for each vary. The important point is to understand that it is a means-tested program, administered by the states to cover health care for various groups considered low-income/vulnerable. Popular Downloads

Popular Downloads

Get Our Newsletter!

Get Our Newsletter! Mission Statement

Mission Statement